Opening:

Excerpt:

Pastor Chris Brown: We’re teaching a lot whenever we say, hey, listen, go out and borrow $40,000 for four years of college. You’re teaching them that whenever they graduate, that this is going to be normal. Yeah, everyone’s got a car payment. Everyone’s got student loan payments. Everyone’s got – no, everyone doesn’t. And, uh, you want more for them. The average person’s graduating from college right now with $37,000 of student loans.

End of Excerpt

John Fuller: Chris Brown describing some of the financial challenges that your young adult will face as they transition out of your home to live on their own. Chris is an advocate for biblically-based money management, and you’ll hear more from him today on “Focus on the Family.” Your host is Focus president Jim Daly, and I’m John Fuller.

Jim Daly: John, you’ve got a couple of kids that are in that spot, right? They’ve moved out of the house, and maybe moved back – I don’t even know.

John: It depends on the day. (Laughter) Anywhere from two to four children and friends will be with us for the night and possibly the week or the month or – who knows?

Jim: And then the next day, they’re all gone.

John: Yeah, it’s kind of fluid. (Laughter) The situation’s fluid, Jim.

Jim: It’s going to be interesting. I can’t wait for Trent and Troy. I don’t know what…

John: If they take off, will they stay out of the house, or will they come back?

Jim: You never know, do you? That’s something we’re going to talk about today, not only to launch your kids, period, but to launch your kids well in Christ, pursuing a relationship with Christ.

I know as parents, that’s the number one thing on your heart when you have kids that are 15, 16, 17, and probably 20, 21, 22. And we’re going to have that discussion today.

You know, Focus on the Family is here for you. If you’re struggling with a prodigal child, or a child that just simply hasn’t launched well, call us. Let us equip you with resources and counseling, uh, to give you some biblical perspective on what can be done at that point. We’re here for you.

John: And, our number is 800-232-6459 if you’d like to talk through some of what you’re dealing with with one of our counselors. 800-232-6459.

And Chris Brown is a pastor and speaker and part of the speaking team for Ramsey Solutions, which is the organization that Dave Ramsey set up in providing financial counseling and encouragement to families. Chris hosts a weekly podcast called Life, Money and Hope, and a daily radio program. And offers, as I said earlier, Bible-based advice and encouragement about better ways to handle your money. And, uh, specifically today, as we noted, we’re going to be talking about helping your kids launch well financially.

Body:

Jim: Chris, welcome to Focus on the Family.

Chris: It’s an honor – big-time honor. Thanks guys.

Jim: Hey, we’re here in Nashville. Uh, you’ve lived here about three and a half years, right?

Chris: Uh-hm. Yeah.

Jim: Miami before that. You’re born in Denver, I mean, you’re a man of this country, right?

Chris: Yes.

Jim: You’ve seen it all.

Chris: Lots of travel. And there is a huge difference between Miami and Nashville, that’s for sure.

Jim: (Laughter) Chris, let me ask you this right from the get-go. Um, you were raised in a single-parent home like I was. And so often we hear the negative statistics about how kids are going to underperform in that area. I think the two of us, uh, beat those odds, obviously. And I’m thinking of the single-parent moms, and dads, who, you know, they’re struggling. The last thing they need is another rock in the – in the backpack saying, your kids have a poorer chance of doing well. Um, speak to that mom or dad who’s trying their best, uh, to do the job like your mom did. Talk about your mom. Why was she special to you?

Chris: Yeah, when I look back to my childhood, I’m very thankful for my mom. She’s a hard-working – three jobs, you know, trying to make ends meet. And, uh, just to back up a tad, uh, you know, my dad – my biological father – left when I was two years old. And then after that, there was many, uh, men that came into the house, whether married or non-married, that provided a lot of violence and a lot of poverty. And so, we were always traveling from abuse shelter to abuse shelter. And my mom was just trying to make things work. And I look back now, and I’m very thankful for the childhood that I had.

Because now I’ve got, you know, three kids of my own and we live in very comfortable suburbia, and there’s a lot of things that I have to teach them that are very hard to teach them that for me was very easy to learn, like contentment and, like, gratitude because – and we didn’t have much. So, I mean, just had a Walkman – remember those Sony Walkman back in the day?

Jim: Right. Maybe an ice cream cone.

Chris: Yes! (Laughter) And it was just – I was so thrilled with some – some of the smaller things in life – a black-and-white TV – whatever it might be. And, uh, you know, I look back now and I remember my mom, um, you know, leaning over and telling me in my ear, she said, hey, it’s not your fault.

John: Hm.

Chris: And I just remember, like, her spirit, her resolve, um. So, I look back, and she was my hero. And a single mom out there, or a single dad that’s out there right now, you’re doing better than you think you are. And, uh, you know, they don’t need the big, huge awesome toy and the go to the big amazing sports camp. I always felt loved. I always felt provided for, and she was teaching me things like hard work, teaching me things like contentment, teaching me things like gratitude. And so, I’m very thankful.

Jim: And some of it is just, uh, you know, being smart or clever. I remember my mom – single-parent mom – working the two or three jobs, just like your mom – and five kids, you know – taking care of five kids, and I was just going into, I think, uh, kindergarten or first grade – I can’t remember. So, she – we had a Twister game. And she bought my school clothes, which, you know, were minimal as it – one pair of pants, underwear, socks. But she had my brother play me in Twister and then they threw the game my direction. I figured this out years later, (Laughs) but each time I won, she’d give me whatever the school clothes, you know, I won my pants. I won my shirts. And I walked away that day feeling like, man, I’m really good at Twister, you know. Look at all the prizes I won. But it was a small thing.

Chris: It is.

Jim: She just thought, how can I make this a little better experience for him? That’s what you’re talking about.

Chris: Yeah. And what she did there was she mixed a need with quality time. And it didn’t cost any money. I mean, literally, it’s not going to Disneyland. Now, I feel like every time I feel like there’s a need in our family, I just take the kids to Disney. I’m like, that’s a $500,000 decision. Like, that’s not what’s necessary. I literally could just sit down with my kids and have a great meal and ask about their day, and they’re going to feel just as filled in their tank.

Jim: Chris, now let’s get up to speed with the topic of what we want to talk about and that’s equipping, you know, the later teens to do better in the launch pattern to get to college or vocational training or their first job – whatever it’s going to be outside the home – how to get them in a better position. Your kids are still young, right?

Chris: Yeah.

Jim: How old are your kids right now?

Chris: Twelve, 11 and nine.

Jim: And you’re working here – Dave Ramsey’s shop. How long have you been working with Dave?

Chris: Three and a half years.

Jim: OK, so you’ve seen it. You’re doing it. You’re training your kids to be ready. What’s the most common, I guess, fail that parents make with their later teens that they’re not doing to prepare their kids for that launch?

Chris: Yeah, well, we say around here a lot that more is caught than taught. And so, you could say a lot of things to do, hey, you want to make sure you budget. Make sure you avoid debt. You want to make sure that you do, you know, do all these things. But unless mom and dad are doing it, even giving generously, the kids need to see you tithing. That’s not why you’re doing it. You’re not doing it to showboat or anything like that, but they just need to see you living out these principles. But I would say probably number one would be living on a budget. Have a plan. If your paycheck’s only 80 bucks a week, what is the plan? What do you do with that? And, of course, you don’t have to call it a budget. It’s not really cool for the kids. You can call it a cash flow plan or a spending plan, which is very liberating.

(Laughter)

You can name it after your dog. You can do whatever you want. But just the whole idea of planning. Another one is that hard work. Just working hard, like, you want paid, you work. And a lot of times we talk about allowance. And I – I hate that word. I really dislike…

Jim: That’s something David shared. He doesn’t like it.

Chris: Yeah, commission. I mean, you’ve got to earn it. You’ve got to go after it.

Jim: I like it.

Chris: And so, uh, that would be another one. And, uh, of course, you know, the whole idea of contentment. I’ve talked on it a couple times already, but to be content that you don’t need to live like mom and dad at 22. It took them 20 years to get there. Alright, you’re not going to live just like mom and dad as soon as you graduate college.

John: Uh-hm.

Jim: You know, so many of us, I think we remember that first job – first one or two jobs. For me really, the first steady job I had was 12 years old working at a Dairy Queen cleaning windows – how about that? – (Laughter) with a squeegee and the whole bit.

Chris: I could see that.

Jim: Then I graduated to (laughing)…

John: That explains your car, (Laughter) which always has clean windows.

Jim: There you go. Then I graduated to, uh, the cash register at about 15. And then I went and did other things. But, uh…

What is the value of those first couple of jobs? And how old should a teenager be as the parents begin to push them in that direction? Twelve might be a little early. I remember I had to have my junior high school principal sign off that I could work.

Chris: That’s so funny. Well, I think the big differentiator for people is the actual paycheck from an outside employer. And I like to want to take that out of the equation. I think if we take that out of the equation, kids should start, uh, working at like, four or five years old around the house.

They should be emptying the dishwasher. They should be putting the laundry from the washer to the dryer.

Jim: Doing their own laundry.

Chris: They should be like my 6-year-old, who has been cleaning out the gutters. No, I’m just kidding, that’s a little dangerous! (Laughter)

Jim: Yeah, right. Forty feet high.

John: What could happen?

Chris: Right, who cares? (Laughter) But like, right now, my 12-year-old mows the grass, you know?

Jim: Right.

Chris: And so, they are – they’re busy, and they get paid commissions.

And when it comes that age – maybe it’s 15, maybe it’s 16 – to get an outside-the-house job, but, man, they need to be working as long as possible because, you know, you think about it. You know, Matthew 25:14-30, the Parable of the Talents. We’ve heard it a thousand times, right?

This whole idea of maximizing gifts – maximizing, uh, money and talents, that applies to young kids as well. If they’ve got the energy, let’s maximize it for God’s glory.

And so, we want to make sure that they are cultivating and maximizing those gifts. And when I’m at events and I ask people, how many of you worked in high school? How many of you worked in college? They all raise their hand. But I’ve noticed they raise their hand in pride. There is something inside of them going, what, yeah, I worked through high school. Don’t rob your kids of that healthy pride. Yes, I earned hard work when, even when I was 14 years old.

Jim: Is that changed today? I mean, are kids not as prideful, uh?

Chris: Yeah, well, you know, I don’t – I think the only time I see a deficiency in this area with kids is when the parents aren’t teaching it properly. So, it’s like, oh, I got to get off the Xbox. That was cultivated somewhere. That’s not – that’s not Junior’s…

Jim: Are you listening in to our conversations? (LAUGHTER)

Chris: I mean, that’s not Junior’s fault originally. Originally, there was no – this – this whole idea of putting value to hard work. And for faith-filled families, to teach that work actually is worship. It’s our way we worship him. We do all things to the glory of God. Whatever you eat, whatever you drink, whatever you do – do to the glory of God.

John: I’m feeling a little convicted right now. We had we had a couple of kids who really had to struggle at school. And we felt like, you know what – throwing a job on top of what we know is already hard work on their part just to maintain good grades – that might just push them over the top and be more than they can handle. What do you think? Should I feel guilty about that? (Laughter) Maybe we should have pressed a little harder?

Chris: Well, I do think that if you think about just our physical bodies, we – before we start running, we walk. Before we start walk, we crawl. And before we crawl, we sit up, right? So, there is this progression that happens – this maturing that happens. I would say that that philosophy, when it comes to college – right? – that Junior can’t work and go to college – I really push back on that. By then they should be mature enough. And the studies have come back that in college when you don’t have a job, versus when you do have a job, you have a lower GPA than if you were to work.

John: Hm.

Chris: It’s amazing.

Jim: So, it’s exactly opposite of what you would think.

Chris: Yes, because it turns out that when Junior’s not working, he’s not studying. He’s majoring in beer pong… (LAUGHTER)

Jim: Wow, that is – that is totally new to my thinking.

John: Yeah.

Jim: Hopefully, yeah, not the party stuff, but maybe they’re studying the Scripture.

Chris: I’m sure. I’m sure.

Jim: Hey – hopefully – the, uh – let me – let me ask you, going back to that 16-, 17-year-old, attitudinally, how do we – how do we begin to train them? Or how do we help accent the training, hopefully, we’ve already done? By letting them run the household bank account? Let them pay our bills? – I’ve heard that suggested, actually.

Chris: There there’s a land in between.

Jim: (Laughing) Yeah…

Chris: ‘Cause that’s, there is.

Jim: …I’ve been worried about, you know, Trent or Troy not making the mortgage payment (laughter), which is possible.

Chris: Right, I’m sure, yeah.

John: Yeah.

Jim: So, I’ve kind of hesitated on them paying the monthly bills. But what are some of those practical things we can do at that age to get them ready for launch?

Chris: Well, one of the great things you can do is, you know, the whole idea of budgeting has gotten more and more simplistic. It’s not as like, you need an Excel spreadsheet, you need a pocket protector. Like literally, you can go to everydollar.com – very simple free budgeting tool. And set up three or four different categories, not 30, but three or four. You’ve got giving, saving, spending. And then, maybe it’s like a – a treat that you want to do next year. Just make it real simple for them.

Another thing you can do is to bring them in on the family budgeting. So, it’s not just between mom and dad, or maybe it’s a single home, it’s maybe not just your – but you bring them in on the discussion, and just bring them in for 15 percent of it.

Jim: I like that.

Chris: Or 30 percent of it, and just so they know a little bit. And then another – a key factor of this is speak their language. Don’t try to speak adult, like, make it cool somehow. Like, you know, kind of dummy it down a little bit so that they can actually, you know, actually absorb it. Put the cookies on the bottom shelf and don’t make it seem so like, you know, I’ve got accrued interest over here. They don’t want to hear accrued interest.

Jim: Well, here’s the thing though, Chris. I mean, budgeting is onerous. That’s how most adults feel about it, so that – that ripples down to the kids too.

Chris: Yes.

Jim: So even Mom and Dad, we’re going, ah…we got to do a budget again. We didn’t keep it last time. And the kids are listening to that, so they can learn disrespect about a budget, and it’s not really that critical. How does Mom and Dad have to behave in order for their kids to better appreciate the benefits of budgeting?

Chris: That’s so good. You know, money was designed to build our marriage, not bust our marriage. And the way that we do that is proactive communication. So, it might not be – don’t use the word budget. Man, try as hard you can because that’s so restricting. But a budget is actually liberating. It allows us to know where the parameters are, where we can have fun within the boundaries. And so, I think, you know, from budgets on the refrigerator to speaking in a positive light and think of it as a dream. You’re going after a dream, and you’ve got the strategy to get there. These are the things we want. We want to travel when we retire. These are the big things we’re going after. We want to go on a big trip four years from now. Here’s how we’re going to get there. So, it’s really a game plan to get to your dream, not a restrictive thing of what we can’t spend.

Zig Ziglar said, if we aim at nothing, we hit it every time. And so many times, it’s exactly how we’re living our life. John Maxwell says, a budget is telling your money where it should go instead of wondering where it went. And, of course, we know what Jesus said in Luke 14:28 – Who in the world would ever build a tower without sitting down first to count the cost. So, man, teach that early to your children.

Jim: Right there, those are convicting thoughts, Chris. I mean, for the parents that have not done it. I mean, Jean and I, we struggle from time to time to get that budget done, and it could be June before we’re going, uh oh, we haven’t done it. So, the point is you – we need to do it. And it’s important.

Chris: Well, here’s the deal. It’s deeper than just money. It’s deeper than just math. It really is. It’s – it’s – it’s a spiritual component. The bottom line is God’s the owner. We’re not the owner. Psalm 24:1 says, the earth is the Lord’s and the fullness thereof. And then in first Corinthians 4:2, the Bible says, those who are – those who are managers should prove faithful. So, it’s about being a faithful steward of God’s resources.

John: Uh-hm.

Chris: So, if we realize it’s not ours, then it’s not about math. It’s more about being a faithful steward.

John: Well, biblical wisdom from Chris Brown on today’s Focus on the Family. And your host is Jim Daly, I’m John Fuller. Find all sorts of great helps as you, uh, try to raise your kids well in this area of finances. We’ll link over to a variety of resources at focusonthefamily.com/radio or call 1-800, the letter A, and the word FAMILY.

Jim: Chris, debt – we’ve touched on that, the crippling nature of it. How do we teach our kids to handle money in a – in a way that they won’t fall in that pit? Is it wise to give them a credit card? Is it, you know, maybe a $250 limit to begin to teach them? What are some of the tools that, again, 16, 17, 18 – uh, where we can teach them the debt trap?

Chris: Yeah, well, I like to teach my kids even now at 12, 11 and nine that a lot of folks are living today – adults – don’t have – their money doesn’t have an opportunity for the future because it has an obligation to the past. Many people are walking around, and they look at the budget and they’ve got 50 percent of income going to something that they committed to a long time ago, whether it be car payments or whether it be credit cards or whatever, so I’m going to teach all the way from the get-go that we don’t want to borrow anything for any reason.

I read Proverbs 22:7 says, the borrower’s enslaved to the lender. It doesn’t say the borrower’s slave to the lender except for when interest rates are advantageous, or except for when you only owe it, and you pay it off at the end of the month. It’s just the fact that it’s wise living. We don’t want to – Romans 13:8 – owe no man anything except for the debt to love one another. So that’s what I’m gonna to teach. I’m gonna teach don’t play the credit score game. The credit score is just a – it’s a number that tells you how great that you play kissy face with the bank. (Laughter) How great you are at borrowing money.

Jim: That’s a great way to put it.

Chris: So that’s – that’s really what I’m – I’m going to teach them from the beginning is, hey, let’s make sure that we save, that we’re patient. And that even that starts with school loans.

Like we’re teaching a lot whenever we say, hey, listen, go out and borrow $40,000 for four years of college. You’re teaching them that whenever they graduate, that this is going to be normal. Yeah, everyone’s got a car payment. Everyone’s got student loan payments. Everyone’s got – no, everyone doesn’t. And, uh, you want more for them. The average person’s graduating from college right now with $37,000 of student loans.

Jim: Right. And, of course, parents that are listening are saying, well, how else can that be done? It’s so expensive. I mean, the only way to do that is through the student loan system, or you know, for – for me and I’m sure for you, I only had $5,000 of debt when I graduated from college. And I thought that was pretty good given where I was coming from.

Chris: And that was just a few years ago (laughter).

Jim: Yeah, just a few, yeah. But let’s not translate real dollars today.

John: Today’s dollars.

Jim: But the point of that is that I worked. I mean, I worked full-time through college and in college, and that just was the right way to do it for me. But what are some practical ways that young people can expect to go through college and have either very minimal debt, or no debt at all?

Chris: And, of course, listening-in folks, this is not a program of condemnation. You know that by now if you’re a frequent listener. But this is just sharing some tidbits of – that’s hope, you know that you don’t have to go into – to student loans to go through college. So, here’s some things you can do if your kids are younger. Let’s just say they’re like, five, six years old, OK?

You can get a 529 plan or an ESA, and we’re not going to get into a bunch of investment instruments here, but look into those, and they’re great tax-free, uh, instruments for you to be able to pay for college later. Now, some of you may be listening in and saying, no, my kids are older. Thank you. I’ve already missed that.

Here’s the three things I want you to do. I want you to first, choose an affordable school. It’s possible.

Jim: That’s the biggest decision.

John: Uh-hm.

Chris: The mascot’s not that cute! (Laughter) It really isn’t. And once you go over the state lines, you go from paying $9,000 a year to $23,000 a year on average. So, going over the state line is not that important. Number two – is scholarships. There’s scholarships for everything. I mean, if you’re left-handed and have rare – red hair, there – there’s a scholarship for that. (Laughter) So make sure you take advantage of scholarships and grants.

Jim: Another one I missed out on.

Chris: Yeah, exactly. And then the other one is work through school. Work through school. In an in-state school, about $9,000 a year. If you do the math, if you work part-time, you will get through school. You could pay for it yourself. I know for me personally, my annual income for my entire family was $11,000 a year growing up when I was in high school years. And my college was $14,000 a year. And I graduated and I paid for my own school.

Jim and John: Hm.

Chris: So, scholarships, working hard – worked at Dillard’s, worked at Raymond James Financial, I painted during the summers, did whatever it took. But I’m convinced there’s not a student loan crisis in America. Yeah, prices are high. There’s not a student loan crisis in America, there’s a parenting crisis in America.

Jim: Huh.

Chris: And again, not condemnation but, man, let’s not let our kids get into that.

Jim: Chris, this is so good. I need to ask you right at the end here though, you know, parents that have fumbled and bumbled along – and folks, we all do it. I’m guilty of it, too. John, maybe not you. (LAUGHTER)

John: Oh, uh, times six. (Laughing)

Jim: OK. What encouragement can you give me if my kids are 15 – let’s just say 15 and 17…

John: 15 and 17 maybe!

Jim: …And I’m worried. You know, it’s not that they’re doing poorly. It’s just this little gnawing in my heart that I haven’t done enough to get them ready. What can I do now, in a crash-course in a year or two, to really get them prepared?

Chris: Yeah, well, one thing I would just tell everybody, and I’m – I’m – I’m included in this because I’m thinking about several mistakes I’ve made this week. But you can only control what you can control. It’s so disempowering to think through the things that you can’t control. So, I always – I’m always about peek at the past, focus on the future.

Jim: Oh, I like that.

Chris: You peek at the past just to learn, but you don’t focus on the past. You focus on the future. So really control what you can control. What you can control is this — and that is being vulnerable and being open and being honest that I’ve dropped the ball as a parent in these areas. The times where I get the most respect from my kids are the times I say, you know what? I approached you with a little bit of anger there, that I was rude to you. I tell you to respect your brother and sister, but I just disrespected you. I’m really sorry. I didn’t lead well right there.

They – they look at me like, you’re the best dad in the world! And I’m like, I feel like, I feel like a chump, right?

Jim: And you’ve taught them something.

Chris: Yes. But I think if – if you’re there right now, and your 16-, 17-year-old like, I think I’ve dropped the ball. They’re not where they need to be. Don’t say, man, you’re not where you need to be. Hey, listen, I’ve really done a poor job of getting you where you need to be in this specific area. Call out some great things in them as well. You know, the compliment sandwich kind of thing.

But, then, just be vulnerable and honest. You’re going to get more parenting chips – and this goes for leadership too, you’re going to get more leadership chips. And that’s something that Dave Ramsey teaches us around here. That you just come out and say, you know what? I missed it. And then you’re just teaching like, you don’t have to be perfect. And we’re all on a journey.

Jim: And you’re owning it.

Chris: It’s not about perfection, it’s about progress.

John: Uh-hm.

Jim: Yeah, I like that. Chris, this has been so good. I hope this has helped you as parents, maybe grandparents, to better understand how to get that late teen ready to go. And, uh, Chris, your stories and your experience have been so helpful today. I’ve got one last thought, but, John, how do people connect and what resource can we put in their hands to help them?

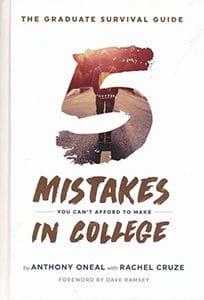

John: Well, Jim, Dave Ramsey’s team has put together a great resource. It’s called The Graduate Survival Guide: Five Mistakes You Can’t Afford to Make in College. And I’m presuming, uh, Chris, that part of that is you should make them before you go to college. (LAUGHTER)

Jim: How about not make ‘em? (Laughing)

John: You can get a copy of it from us at focusonthefamily.com/radio, or when you call 800-A-FAMILY.

Jim: OK, Chris, so here’s the question. I’ve got a 30-year-old son or daughter, and they’re living at home still. I mean, they went off, they tried to launch, but the launch pad blew up (laughing). You know, now they’re back home, and they’re not motivated. This is the tough question. What do I do? ‘Cause this is ground zero. If they don’t launch soon, they’re living off my Social Security.

Chris: Yeah, well, I think as parents we have to ask ourselves, are we helping the situation, or are we enabling the situation? And I think there’s these boomerang kids that kind of bounce right back.

Jim: Uh-hm.

Chris: But then there’s some just failure to launch, and there’s two different mentalities there. And so, you’ve got to ask yourself the variables. OK, what are the variables? Is there a reason, is there a major thing that’s happened in their life, maybe a major relationship thing or an illness or – or some kind of, uh, just major, um, tragedy that happened their life that, you know what, for three or four months, the best way to love them is to have them come back in the household, and let’s re-evaluate.

But whether it’s three or four months, whether it’s two months, whether it’s six months, there needs to be proactive communication from the beginning. Here are the expectations. I feel like if it’s more than three months, I’m enabling you. So, I’m going to show love to you in three months in a different way. I’m going to show love with you, uh, by helping you budget, by helping you dream about some interview possibilities, uh, about maybe going to the place where you’re going to find some affordable rent.

Jim: So reasonable help because of the reasonable circumstance.

Chris: Yeah, but the whole idea from the beginning is to teach them how to manage God’s blessings, God’s way for God’s glory. It’s their connection with the Creator. You want to make sure they’re mature believer, that they know how to steward God’s resources. Because I know for me, I came from a really tough childhood, and a lot of times I got a lot of help.

But I got – I got fish handed to me, but no one ever taught me how to fish. And that’s what your child needs the most is teach them how to fish so they’re not coming back six months later.

Jim: Even at that later age.

Chris: Yeah, yeah.

Jim: Do it today.

Chris: It’s not just a 30-year-old problem. It’s not a four… it’s one of these things where, you know, a lot of us have some kind of characteristic inside of us that we would still have today – a bad characteristic – if someone didn’t call it out in us and love us enough not to enable us, but to actually help us and fix that characteristic.

Jim: Yeah. Chris, thanks for being with us.

Chris: Thank you. It’s an honor.

Closing:

John: We had a great conversation with Chris Brown, who’s part of Ramsey Solutions. That’s Dave Ramsey’s organization offering financial advice and encouragement to families. And they’ve got a perfect follow-up resource on this topic. We’re offering it. It’s called The Graduate Survival Guide: 5 Mistakes You Can’t Afford to Make in College. And we’d love to send a complimentary copy of the book to you when you send a financial gift of any amount to Focus on the Family today. Uh, may be our way of saying “thank you” for helping us equip parents and strengthen families through broadcasts like this one.

Donate today at focusonthefamily.com/radio. Or when you call 800-232-6459. 800 – the letter “A” and the word FAMILY. And when you get in touch, be sure to order a CD or audio download of our conversation to pass along to a friend.

And let me mention another great resource we have. It’s called Mvelopes, and uh, it’s tooled to help you with budgeting and money management. There’s an app and a website, and it’s going to help you save 10 to 20-percent of your living expenses. And we’re gonna post a link to Mvelopes over at focusonthefamily.com/radio.

Well, coming up next time on this broadcast, one man’s dramatic story of addiction and how it impacted his family and faith . . .

Teaser:

Mr. Gary Moreland: …She was going to church and that – I was OK with that. That was – that was OK. She’d take the kids. Church is a good thing. That’s a good thing. She tried to take me, and it’s like, well, I can’t drink if I go to church. I mean, Jim, I’m drinking every day.

End of Teaser